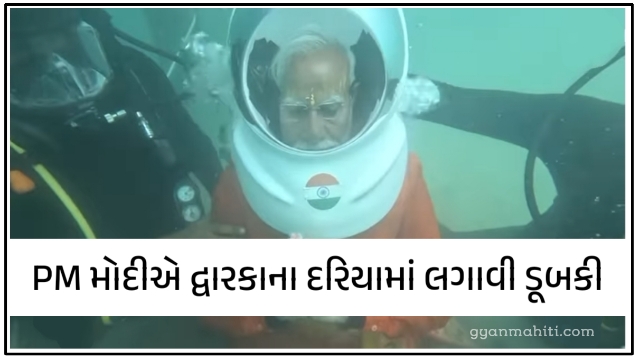

PM Modi took a dip in the sea of Dwark

Credit card companies use your credit score to assess your risk of lending you money. Most banks require a credit score above 750 points to proceed with the application process.

According to Bajaj Markets, most credit card issuers require a minimum monthly income of ₹10,000. However, the minimum salary required to apply for a credit card can vary depending on the card issuer. For example, HDFC Bank requires a minimum monthly salary of ₹10,000 for an HDFC credit card. HDFC Bank’s MoneyBack Credit Card has a minimum income requirement of ₹13,500 per month.

Here are some things to consider when applying for a credit card:

EligibilityYou should use an eligibility checker before applying for a credit card. Eligibility checkers are a quick way to gauge whether you’re likely to be accepted for a card without having to fill out a full application.

- DocumentsYou may need to provide the following documents:Passport-size photograph

- Identity proof such as passport, driving license, or Aadhaar card

- Address proof such as utility bill, rental agreement, or bank statement

- Income proof such as payslips, or IT return filings, or business registration documents

Employment statusYour employment status also counts when it comes to evaluating your credit card eligibility. Being in the present job for at least one year is essential to qualify.

Age

You must fall into the age limit set by the bank. The applicant should be minimum of 18 years old.

You can apply for a credit card by filling up an application form, either online or on paper. You can also compare multiple credit cards at the same time through a platform like Paisabazaar.

Some credit card issuers offer online prequalification, though some call it preapproval. If you receive a credit card offer in the mail saying you’ve been preapproved, it means you’ve been prescreened with a soft inquiry.

This is not professional financial advice. Consulting a financial advisor about your particular circumstances is best.

Some credit cards for low-income earners include:

You can apply for a credit card by filling up an application form, either online or on paper. You can also compare multiple credit cards at the same time through a platform like Paisabazaar.

Some credit card issuers offer online prequalification, though some call it preapproval. If you receive a credit card offer in the mail saying you’ve been preapproved, it means you’ve been prescreened with a soft inquiry.

This is not professional financial advice. Consulting a financial advisor about your particular circumstances is best.

Some credit cards for low-income earners include:

- SBI SimplyCLICK Credit Card

- HDFC MoneyBack Credit Card

- ICICI Coral Contactless Credit Card

- YES Bank Prosperity Reward Plus Credit Card

- HDFC Easy EMI Credit Card